Sweepstakes for Back-to-College Dorm Room Essentials

Heading off to college marks an exciting new chapter, but preparing a dorm room can quickly become expensive. From bedding and storage to electronics and study supplies, the list of essentials grows fast. This is why sweepstakes for back-to-college dorm room...

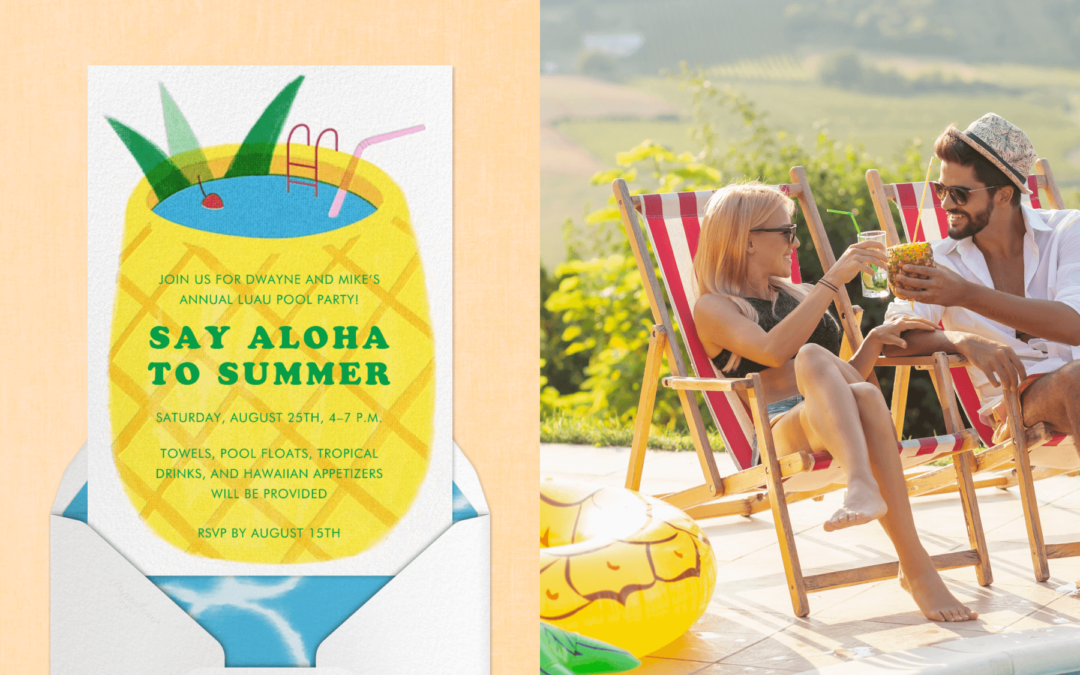

Sweepstakes for Summer Pool and Beach Gear

Summer is the season of sunshine, relaxation, and outdoor fun, and nothing defines it more than time spent at the pool or the beach. Whether it’s lounging by the water, hosting backyard pool parties, or planning seaside vacations, the right gear can make all the...

Sweepstakes to Win Fitness Goals for New Year’s Resolutions

The start of a new year brings a renewed sense of motivation and hope, and for many people, fitness goals sit at the top of the resolution list. Whether the aim is to lose weight, build strength, improve flexibility, or simply live a healthier lifestyle, January...

Sweepstakes for Holiday Decorations: How to Win Festive Décor Without the Extra Cost

Holiday decorations play a powerful role in shaping the spirit of the season. They transform ordinary spaces into warm, joyful environments filled with color, light, and tradition. Whether it is twinkling lights during winter, pumpkins and wreaths in the fall, or...

Sweepstakes to Win Thanksgiving Dinner Ingredients: How to Score a Free Holiday Feast

Thanksgiving is a time for gratitude, togetherness, and sharing a meal with the people who matter most. It is a holiday built around food, tradition, and the comforting feeling of gathering around a table filled with familiar dishes. At the same time, preparing a...

Sweepstakes for Father’s Day BBQ Essentials: How to Win the Ultimate Grilling Setup for Dad

Father’s Day is a celebration of love, appreciation, and the special role fathers play in our lives. For many families, it is also a day filled with laughter, togetherness, and delicious food shared around the grill. The image of dad flipping burgers, checking ribs,...

Sweepstakes for National Pet Day Prizes: How to Win Treats, Toys, and More for Your Furry Friends

National Pet Day is a heartfelt celebration of the animals who bring joy, comfort, and companionship into our lives. Pets are more than just animals; they are family members, emotional support, and constant sources of happiness. From wagging tails and gentle purrs to...

Sweepstakes for Earth Day Giveaways: How to Win Eco-Friendly Prizes and Support the Planet

Earth Day is more than just a date on the calendar. It is a global reminder of our responsibility to care for the planet and protect the environment for future generations. Every year, individuals, communities, and businesses come together to promote sustainability,...

Sweepstakes to Win Wedding Gifts: How to Score Amazing Prizes for Your Big Day

Weddings are beautiful milestones filled with love, commitment, and the promise of a shared future. They are also major life events that require careful planning, emotional energy, and significant financial investment. From venues and décor to attire and catering,...

Sweepstakes for New Baby Essentials (Baby Shower Prizes): How to Win Big for Your Growing Family

Welcoming a new baby is one of life’s most joyful and emotional experiences. It is a time filled with anticipation, planning, and dreams about the little life that is about to begin. At the same time, it can also be overwhelming. From diapers and clothing to cribs,...