Approximate retail value is the anchor for any fair promotion. It tells the audience what a prize is likely to sell for on the open market. This glimpse helps entrants judge prize worth before they decide to enter.

ARV is not a random tag. Sponsors base it on market value, not internal cost, and document how totals were calculated. Clear disclosure builds trust and makes comparisons easy.

Disclosure also links to taxes and paperwork. Winners of higher ARV prizes may face reporting rules, so transparency keeps rules defensible and participants informed.

Read on for a simple process and a practical example that shows how prize price, market quotes, and inclusions work together. By the end, readers can read or write rules that match expectations and reduce surprises for any winner.

ARV in Sweepstakes: What It Means, Why It Matters, and How It Differs from Fair Market Value

A clear number for prize worth helps entrants judge a promotion at a glance.

arv is the standard retail tag sponsors list in Official Rules so entrants know what a prize represents in plain terms. It reflects the price a typical buyer would see at major stores or on reputable online sites. This number sets expectations before anyone spends time entering.

Defining the retail amount for prizes

Think of this figure as the advertised sticker price for a product or package. Sponsors often itemize parts of a prize and then present a total arv for clarity.

arv versus fair market value

arv leans on advertised retail price. Fair market value is what a buyer and seller would agree on in open commerce. Taxes commonly follow the latter, so winners may owe based on an amount different from the stated figure.

Why clear disclosure matters

When rules disclose arv and list methodology—like which retailers or MSRP dates were used—entrants gain trust. A transparent section in the rules cuts confusion and speeds winner communications after the promotion ends.

| Item | Typical Meaning | Implication for Winners |

|---|---|---|

| arv | Advertised retail price | Sets perceived prize worth and marketing appeal |

| Fair market value | Price in open market | Often used for tax reporting |

| Total ARV | Sum of all prizes | Affects registration thresholds and public perception |

| Disclosure practice | Itemized listings and methodology | Builds trust and defends rules |

How to Calculate ARV: A Practical, Step‑by‑Step Method

Collecting live price quotes from multiple sellers builds a realistic baseline for any prize estimate.

Start with retail price research

Pull current listings from major retailers, marketplaces, and manufacturer pages. Compare MSRP and sale tags for the same or a closely comparable product.

Roll in associated costs

Add shipping, handling, typical sales tax where the winner would pay, and any required fees. These amounts change what a consumer actually pays and shift the total.

Timing, location, and method

Check regional pricing, availability, and seasonality. Then pick a valuation method that fits: retail price, fair market comparisons, replacement cost, or cost‑plus markup.

Travel and documentation

For travel prizes, gather at least three quotes for airfare and transfers, add hotel rates and listed extras, and note exact inclusions. Summarize each item and the total in the official rules.

| Valuation method | Best use | Notes for defensibility |

|---|---|---|

| Retail price | Common goods | Use current listings from major sellers |

| Fair market | Fluctuating items | Compare recent sales and comparable products |

| Replacement cost | Discontinued items | Estimate cost for an equivalent purchase |

Rules, Taxes, and Compliance: Getting ARV Right in the United States

Plain, itemized rules help a business meet state filing and tax requirements without guesswork. The Official Rules must list the ARV for each prize and show a clear total ARV. Base those numbers on retail listings, not internal cost, so entrants see realistic figures.

Official rules requirements

The rules should itemize each prize and present a summed total ARV. Disclose arv using current retail prices, list travel inclusions and exclusions, and note any fees the winner must pay.

Tax implications for winners

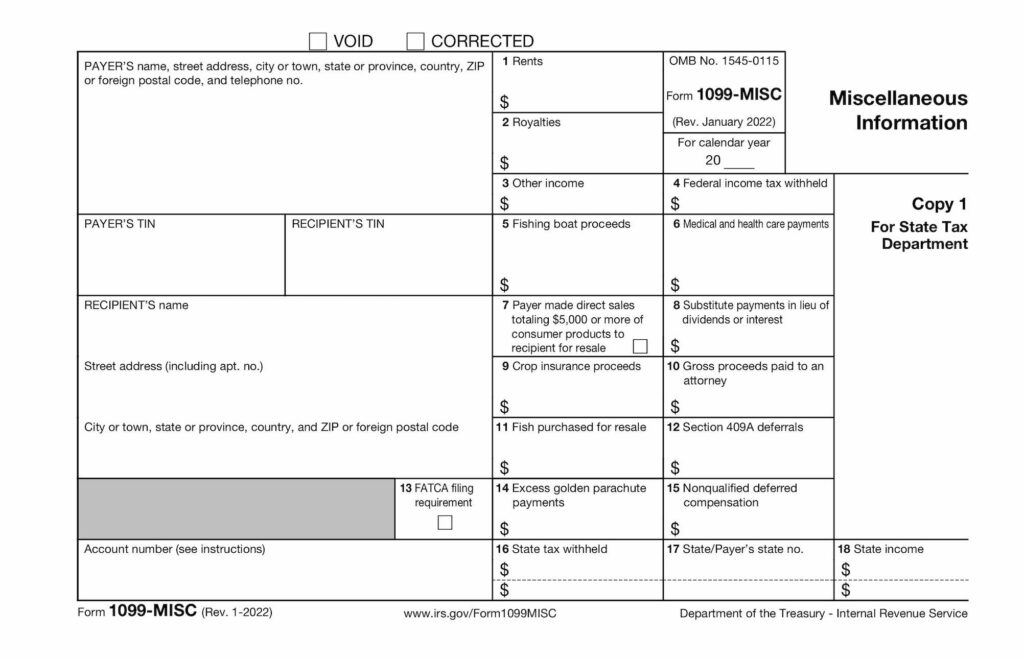

The IRS uses fair market amounts when it assesses tax. If a winner gets a prize with ARV of $600 or more, sponsors generally issue IRS Form 1099‑MISC and file with the IRS.

Cash prizes are taxed at face value. Non‑cash awards may have differing FMV, so explain the method used in the rules and advise winners they may owe tax on the FMV.

Registration and bonding thresholds

Some states require filings before a promotion runs. New York and Florida typically require registration and bonding when the total ARV exceeds $5,000. Rhode Island requires registration for in‑store retail promotions at $500 or more, though bonding is not required there.

- Confirm state timelines and registration requirements for multi‑state promotions.

- Keep copies of quotes, product links, and date‑stamped sources for defense and audits.

- Be explicit about airfare, hotel nights, resort fees, and transfers for travel prizes.

Clear rules reduce disputes, meet requirement checklists, and protect both the sponsor and the winner. Well‑documented compliance files make filings and tax reporting straightforward.

Conclusion

, A trustworthy prize figure comes from retail checks, documented quotes, and plain disclosure. Base your arv on public retail listings, not internal cost, and list each prize and the summed total in the rules.

For travel, gather multiple quotes and note exact inclusions. Remember that tax reporting often uses fair market numbers; sponsors typically issue Form 1099‑MISC when a prize meets the $600 threshold.

Track sources, refresh data before launch, and keep a checklist for price, cost, market, and product details. Clear disclosure protects the business and builds trust with the audience, making future sweepstakes and arv prize work faster and fairer.