by clicejames | Oct 17, 2025 | Sweepstakes by Prize Type

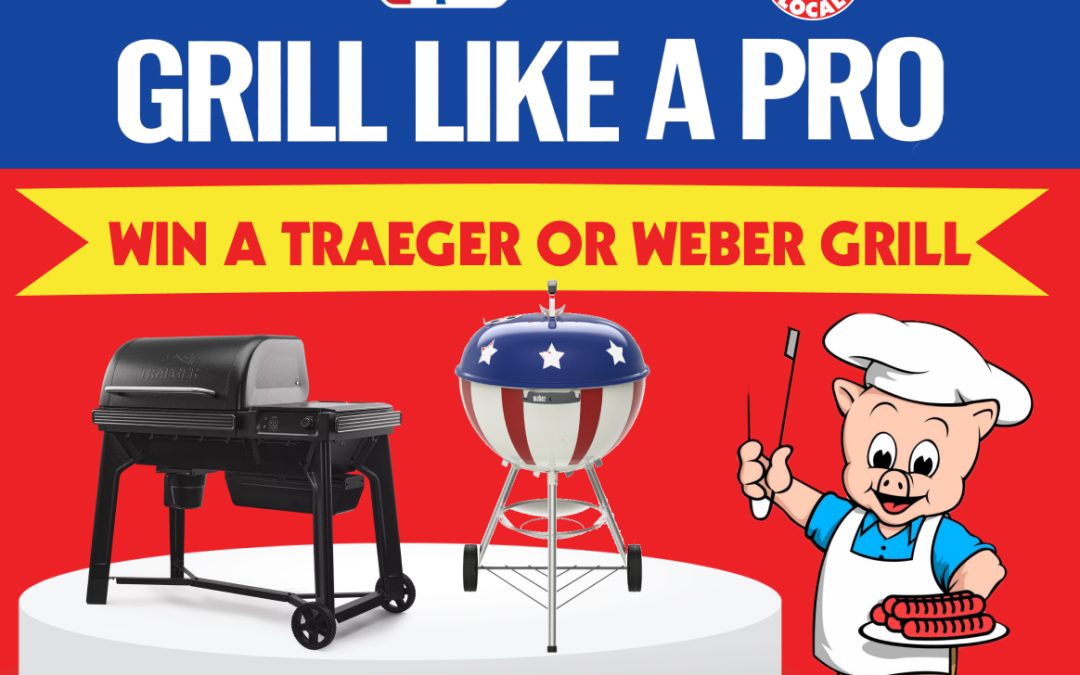

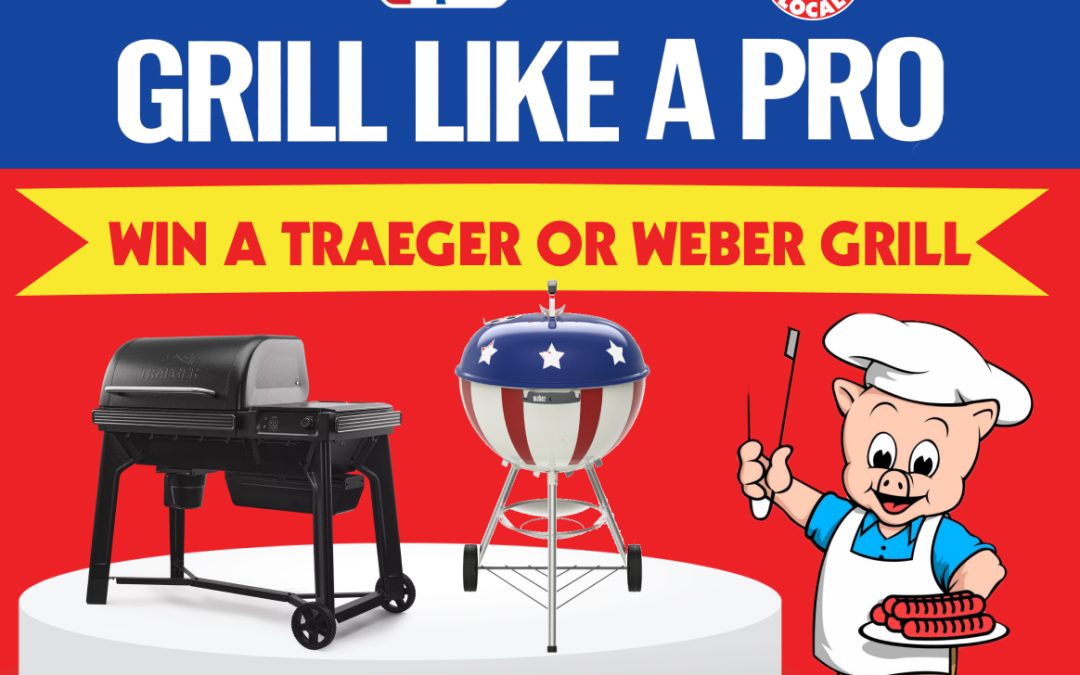

Summer is here, and it’s the perfect time to elevate your cooking game. Imagine firing up a Traeger Timberline Grill, valued at $3,000, in your backyard. This is just one of the incredible prizes up for grabs in this exciting opportunity. Four lucky winners will take...

by clicejames | Oct 17, 2025 | Sweepstakes by Prize Type

The holiday season brings incredible opportunities to save and enjoy special rewards. Many top brands, including Amazon, Walmart, and Target, are offering exclusive promotions this year. These promotions are designed to make the season even more festive and...

by clicejames | Oct 17, 2025 | Sweepstakes by Prize Type

Imagine not worrying about fuel costs for an entire year. SpeeDee, MAPCO, and Circle K are offering incredible prizes to make that dream a reality. With total prize pools ranging from $1,500 to $3,650, this is an opportunity you won’t want to miss. Entry methods are...

by clicejames | Oct 17, 2025 | Sweepstakes by Prize Type

Are you ready to win big? Fly Fusion’s 12-week gear giveaway is here, offering you the chance to take home incredible prizes. But hurry, this opportunity ends on April 14th! If you’re a fan of outdoor adventures, the Trail Running Film Festival is also stepping up...

by clicejames | Oct 17, 2025 | Sweepstakes by Prize Type

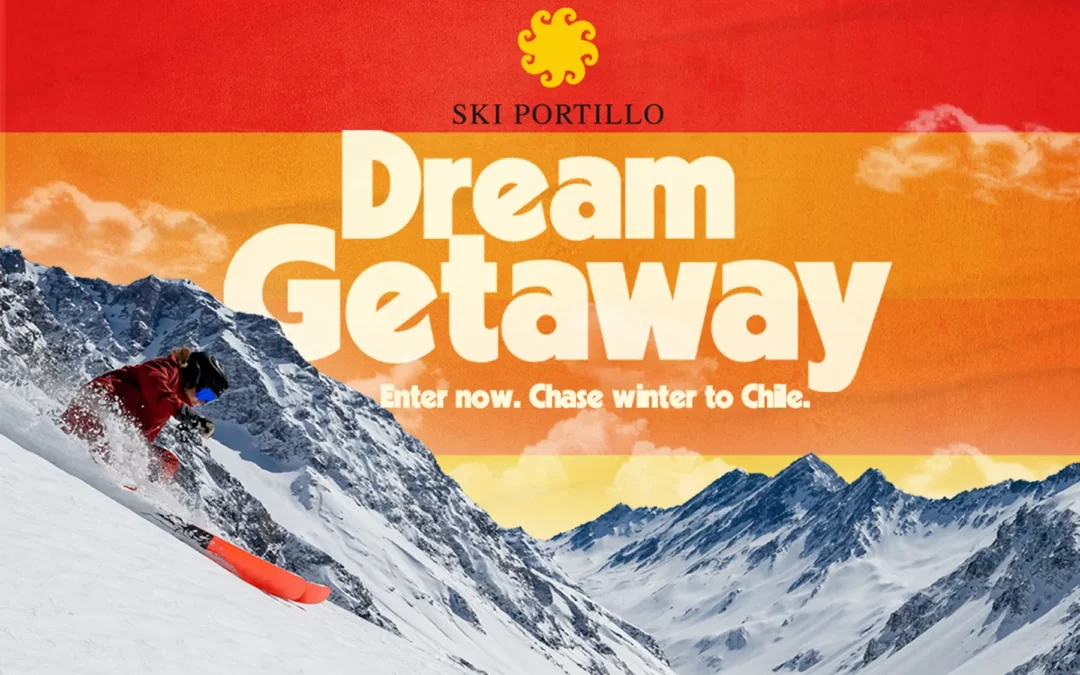

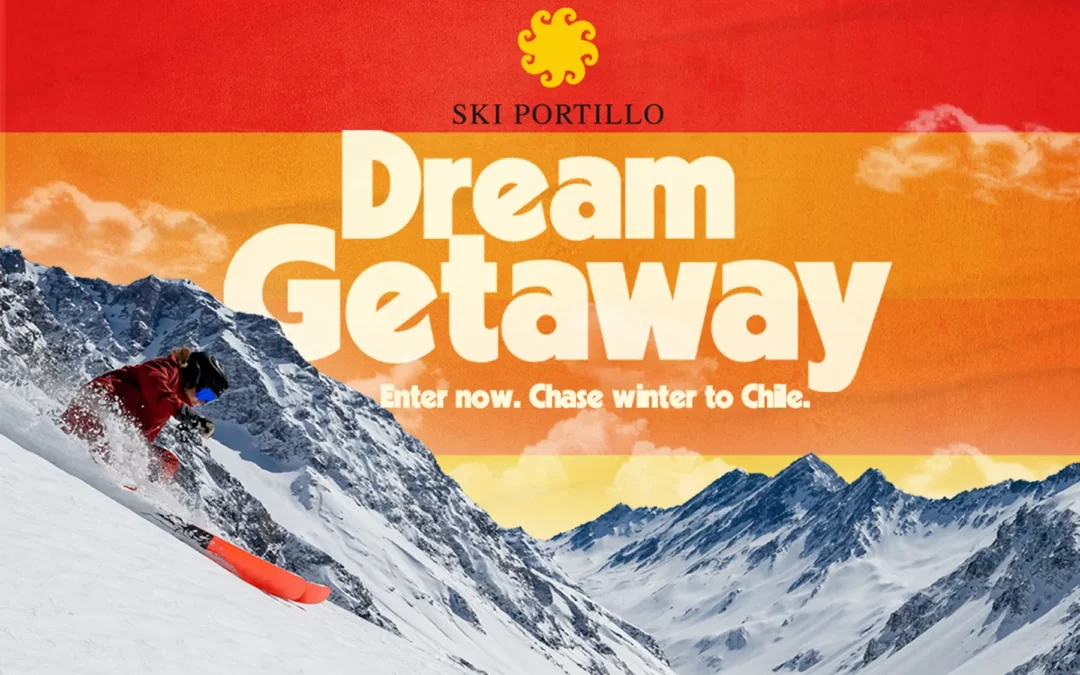

Get ready for an unforgettable adventure! The 2025 ski sweepstakes are opening soon, offering life-changing prizes that could make your winter dreams come true. From thrilling mountain escapes to premium gear packages, this is your chance to elevate your ski...