Sweepstakes for Valentine’s Day Dinner Dates: How to Win a Romantic Night Out

Valentine’s Day is all about love, connection, and meaningful moments shared with someone special. For many couples, one of the most anticipated traditions is going out for a romantic dinner. Candlelit tables, carefully prepared meals, and an intimate atmosphere...

Sweepstakes to Win Holiday Travel Packages: How to Turn Your Dream Getaway into Reality

The holiday season is one of the most exciting times of the year, filled with celebrations, family gatherings, and the desire to escape routine and experience something special. For many people, this also means traveling, whether it is to visit loved ones, relax in a...

Sweepstakes for Winter Sports Gear: How to Win the Equipment You Need This Season

Winter is the season of adventure for skiers, snowboarders, ice skaters, and outdoor enthusiasts who thrive in cold weather. As snow begins to fall and slopes open, many people start planning trips, upgrading equipment, and preparing for winter sports activities....

Sweepstakes to Win Tickets to Summer Music Festivals: How to Enter & Rock the Season

Summer music festivals are the highlight of the season for fans of live music, good vibes, and unforgettable experiences. From large-scale multi-day festivals with world-renowned headliners to crowd-favorite regional events and niche genre gatherings, festival season...

Sweepstakes for Fall Fashion and Accessories: How to Enter & Win Stylish Rewards

Fall is more than crisp air, pumpkin spice, and cozy layers. It is also one of the most exciting seasons for fashion. As temperatures cool and wardrobes transition, brands release fresh collections filled with boots, knitwear, jackets, scarves, handbags, and statement...

Sweepstakes for Fourth of July Celebrations: How to Enter & Win Big This Independence Day

The Fourth of July is more than fireworks, backyard barbecues, and patriotic parades — it’s a time of celebration, community spirit, and summer fun. Many brands and companies use this holiday to launch exciting Independence Day sweepstakes that offer prizes tied to...

Sweepstakes to Win Graduation Gifts: How to Enter & Celebrate Your Achievement

Graduation is a milestone worth celebrating — a day that marks years of hard work, growth, and new beginnings. But while the ceremony itself is memorable, the cost of graduation gifts can add up quickly. From laptops and tech accessories to travel experiences, gift...

Sweepstakes for Spring Cleaning Must-Haves: How to Win Essentials for a Fresh Start

Spring is the season of renewal — a time when homes get a fresh look, closets get organized, and long-neglected areas finally see the light of day. Beyond just cleaning products, spring cleaning often involves decluttering, redecorating, upgrading tools, and...

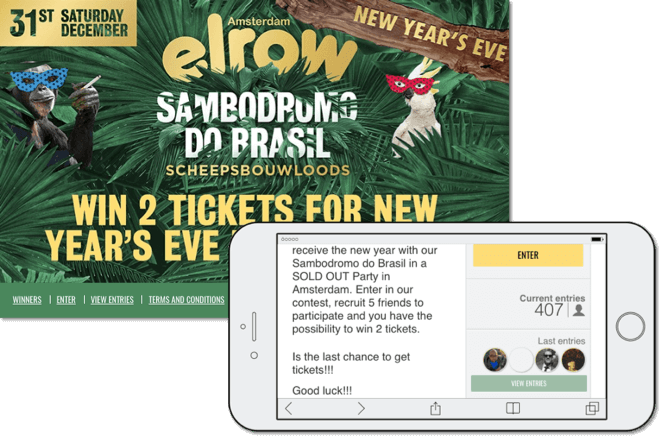

Sweepstakes to Win New Year’s Eve Party Tickets: How to Enter & Celebrate in Style

New Year’s Eve is one of the most exciting nights of the year — a time to reflect on the past, celebrate accomplishments, and ring in a fresh start with friends and loved ones. For many people, the biggest part of the celebration is attending a memorable event — a...

Christmas Sweepstakes for the Entire Family

Christmas is a season of joy, generosity, and togetherness. It is a time when families gather, homes are filled with laughter, and gift-giving becomes a meaningful tradition. Beyond shopping sales and holiday discounts, many brands and companies run Christmas...