by clicejames | Sep 23, 2025 | Sweepstakes by Prize Type

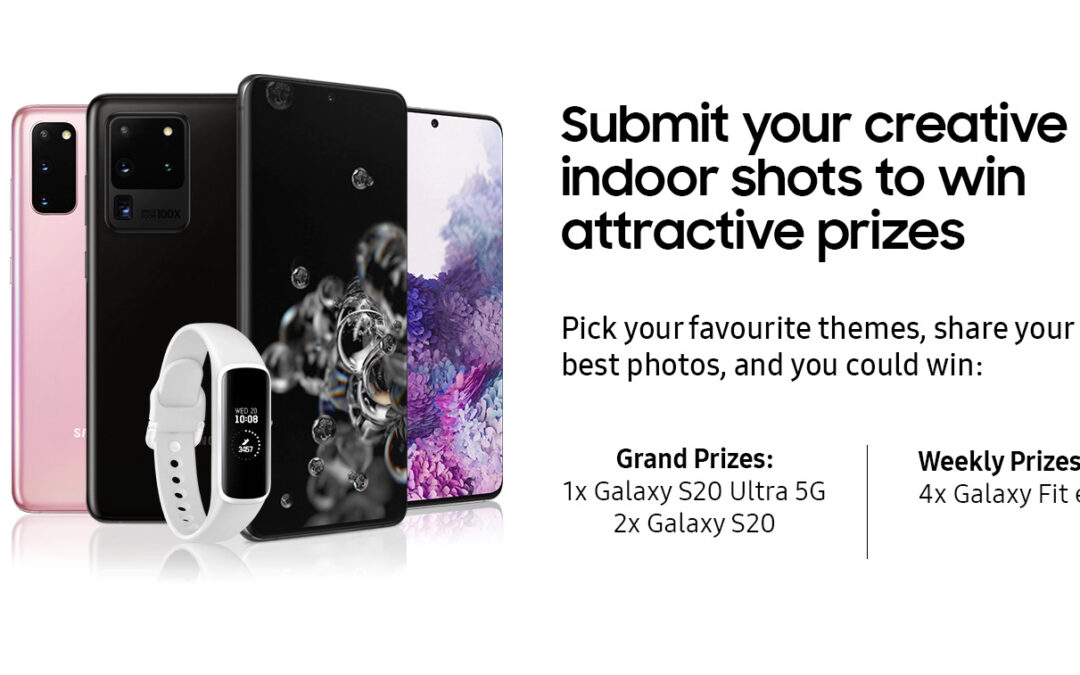

Explore a clear, user-friendly directory of past promotions that featured top phone models and tech prizes. This guide highlights what each listing required, who qualified as participants, and where official ARV and timing details appear. Most promotions were...

by clicejames | Sep 23, 2025 | Sweepstakes by Prize Type

Applying to quick-entry award draws can be one of the fastest ways to fund education. Many U.S. programs let high school seniors and current undergraduates submit short forms, email signups, or tiny creative prompts each month. These low-lift options fit busy...

by clicejames | Sep 23, 2025 | Sweepstakes by Prize Type

Sweepstakes Fanatics curates reliable sweepstakes and posts a Hot Picks list that helps readers spot quality offers fast. Recent prizes include cash, gift cards, tech bundles, and trips to New York City and Asheville. The site also runs Instant Win Games and keeps a...

by clicejames | Sep 21, 2025 | Sweepstakes by Prize Type

This short guide lays out the typical process after an entry is selected in a promotion. First, a notification may arrive by email, postal or registered mail, phone, or social media. Make sure your name, mailing address, phone, and email are accurate on the form. A...

by clicejames | Sep 21, 2025 | Sweepstakes by Prize Type

Ready to win high-value style without the guesswork? This quick guide curates current themes and prize types you’ll see across today’s promotions. It’s a clear list that helps you find the best way to enter and increase your chances to win standout pieces and curated...